Can I Claim Luggage As Business Expense . business expenses on vacation are deductible: You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. learn the irs rules and tips for claiming travel expenses as business deductions. if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. Find out what qualifies as a business trip, what expenses are tax. standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and.

from www.sampleforms.com

standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. business expenses on vacation are deductible: You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. learn the irs rules and tips for claiming travel expenses as business deductions. Find out what qualifies as a business trip, what expenses are tax.

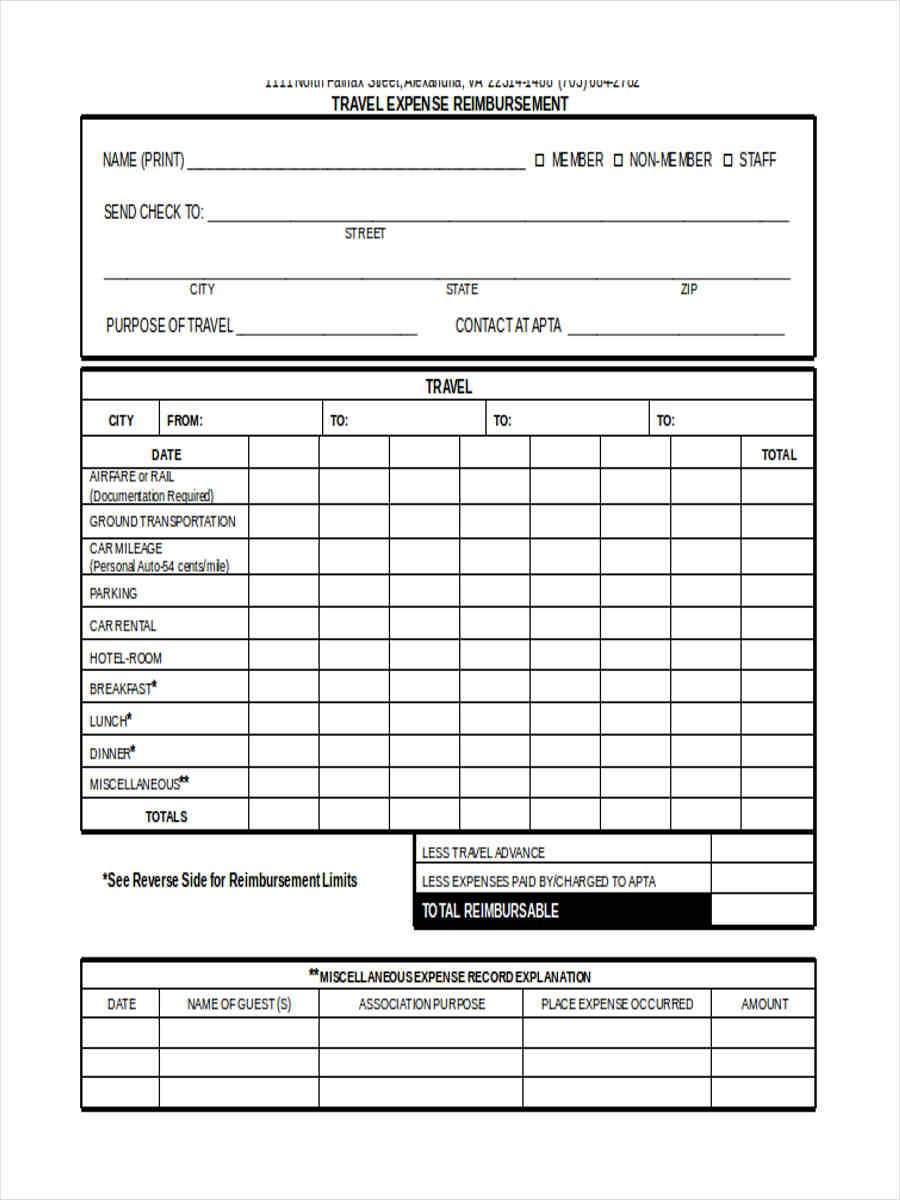

FREE 7+ Sample Travel Reimbursement Forms in MS Word PDF Excel

Can I Claim Luggage As Business Expense Find out what qualifies as a business trip, what expenses are tax. business expenses on vacation are deductible: learn the irs rules and tips for claiming travel expenses as business deductions. standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. Find out what qualifies as a business trip, what expenses are tax. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job.

From www.flieger-luggage.com

Abs 3pcs Set Business Luggage Tsa Lock Trolley Bag Check in Bag Zipper Can I Claim Luggage As Business Expense learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. business expenses on vacation are deductible: learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and. Can I Claim Luggage As Business Expense.

From ebillity.com

Top 10 Tips for Tracking Your Business Expenses Effectively eBillity Can I Claim Luggage As Business Expense learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or. Can I Claim Luggage As Business Expense.

From www.dreamstime.com

Travel Insurance Tag on Suitcase Holder with Tag Tied Letters En Stock Can I Claim Luggage As Business Expense learn the irs rules and tips for claiming travel expenses as business deductions. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. if the luggage is used solely for business travel you can deduct the purchase as a business expense. . Can I Claim Luggage As Business Expense.

From fr.aegeanair.com

Bagages Retardés / Endommagés Aegean Airlines Can I Claim Luggage As Business Expense standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. learn the irs rules and tips for claiming travel expenses as business deductions. learn how to deduct ordinary and necessary expenses of traveling. Can I Claim Luggage As Business Expense.

From www.sydneyluggage.com.au

Business Luggage Business Bags Online Sydney Luggage Can I Claim Luggage As Business Expense if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. learn how to deduct ordinary and necessary expenses of traveling away from home for. Can I Claim Luggage As Business Expense.

From www.jbsolis.com

THOUGHTSKOTO Can I Claim Luggage As Business Expense You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. learn the irs rules and tips for claiming travel expenses as business deductions. learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. business expenses on vacation are deductible: Find out what qualifies as a. Can I Claim Luggage As Business Expense.

From template.wps.com

EXCEL of Travel Expenses Report.xls WPS Free Templates Can I Claim Luggage As Business Expense learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. Find out what qualifies as a business trip, what expenses are tax. learn the irs rules and tips for claiming travel expenses as business deductions. learn how to deduct ordinary and necessary. Can I Claim Luggage As Business Expense.

From shershegoes.com

The Best Business Luggage Pieces for Your Next Trip Can I Claim Luggage As Business Expense learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. business expenses on vacation are deductible: if the luggage is used solely. Can I Claim Luggage As Business Expense.

From www.typecalendar.com

Free Printable Claim Letter Templates [PDF, Word] Examples Can I Claim Luggage As Business Expense learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn the irs rules and tips for claiming travel expenses as business deductions. You can qualify for a small deduction if you go somewhere. Can I Claim Luggage As Business Expense.

From slbag.net

Guide of Starting Your Leather Bag Production Business SLBAG Can I Claim Luggage As Business Expense You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. Find out what qualifies as a business trip, what expenses are tax. business expenses on vacation are deductible: learn how to deduct ordinary. Can I Claim Luggage As Business Expense.

From www.starterstory.com

27 Trending Luggage Products Businesses [2024] Starter Story Can I Claim Luggage As Business Expense business expenses on vacation are deductible: if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. learn the irs rules and tips for claiming travel expenses as business deductions.. Can I Claim Luggage As Business Expense.

From www.istockphoto.com

Business Travel Businesspeople With Luggage Stock Illustration Can I Claim Luggage As Business Expense standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept. Can I Claim Luggage As Business Expense.

From www.zafire.com

Baggage Management Zafire Aviation Can I Claim Luggage As Business Expense Find out what qualifies as a business trip, what expenses are tax. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. learn the irs rules and tips for claiming travel expenses as business deductions. You can qualify for a small deduction if. Can I Claim Luggage As Business Expense.

From www.printxpand.com

How to Start a Custom Bag and Purse Business PrintXpand Can I Claim Luggage As Business Expense if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn the irs rules and tips for claiming travel expenses as business deductions. business expenses on vacation are deductible: Find out what qualifies as a business trip, what expenses are tax. learn how to deduct business travel expenses. Can I Claim Luggage As Business Expense.

From snazzytrips.com.au

Tips For CarryOn Luggage Snazzy Trips Travel Blog Can I Claim Luggage As Business Expense business expenses on vacation are deductible: learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. if the luggage is used solely for business travel you can deduct the purchase as a business expense. You can qualify for a small deduction if you go somewhere for vacation and. Can I Claim Luggage As Business Expense.

From voicesfromtheblogs.com

A CostEffecitve And Environmentally Friendly Way Of Shipping Your Luggage Can I Claim Luggage As Business Expense if the luggage is used solely for business travel you can deduct the purchase as a business expense. learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can qualify for a small deduction if you go somewhere for vacation and incidentally work while. Find out what qualifies. Can I Claim Luggage As Business Expense.

From www.amazon.com

Strenforce Luggage Sets Lightweight 3 Piece Luggage Set Can I Claim Luggage As Business Expense standard business travel expenses include lodging, food, transportation costs, shipping of baggage and/or work items, laundry and. learn how to deduct business travel expenses from taxes, including the golden rules, the definition of tax home, and the concept of ordinary and necessary. learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,.. Can I Claim Luggage As Business Expense.

From www.dreamstime.com

Inspiration Showing Sign Tourist Luggage. Business Overview Big Bag Can I Claim Luggage As Business Expense learn how to deduct ordinary and necessary expenses of traveling away from home for your business, profession, or job. business expenses on vacation are deductible: learn how to claim deductions for qualifying business travel expenses, such as transportation, accommodation, meals,. You can qualify for a small deduction if you go somewhere for vacation and incidentally work while.. Can I Claim Luggage As Business Expense.